Corporate Governance

Our principles-based governance provides the base for our many actions leading to sustainable value creation. We continue to balance the pursuit of top-line and bottom-line growth with capital efficiency. Aiming for business to be a force for good, we use our scale, resources and expertise to create shared value for all our stakeholders.

We are on track to achieve our near-term climate commitments, guided by our detailed Climate Roadmap to achieve zero net greenhouse gas emissions by 2050. Peak carbon and peak plastic are behind us, even as our business continues to grow. Our shareholders strongly supported this ambition at our 2021 Annual General Meeting. In 2023, shareholders endorsed our revised Articles of Association, which allowed us to implement the new Swiss corporate law a year ahead of schedule. As from 2024, our shareholders will have the opportunity to vote on our comprehensive annual Sustainability and Creating Shared Value Report.

We actively engage with our shareholders through roadshows, investor days and meetings, and Chairman’s roundtables in different locations around the world. These interactions with our shareholders throughout the year provide us with valuable insights and help us refine our strategic priorities and our environmental, social and governance agenda.

Our diverse and competent Board of Directors is engaged to oversee the direction of our company. We have continuously strengthened the Board by adding new independent directors with diverse experience and expertise directly relevant to Nestlé, for example, with respect to food systems, food and beverage, digitalization, marketing, sustainability, geopolitics and other topics.

Under our governance, the full Board is in charge of strategy, governance and risk oversight. Our Chair’s and Corporate Governance Committee regularly reviews all aspects of our governance, as well as our asset and liability management. Our Nomination Committee, chaired by our Lead Independent Director, evaluates Board composition, performance, structure and succession planning, and assesses candidates for nomination to the Board. Our Sustainability Committee advises on our environmental and social sustainability strategy and reporting, including our response to climate change and our human rights due diligence program. Our Compensation Committee ensures alignment of our remuneration systems with our values, strategies and performance. Our Audit Committee oversees internal and external audit, financial and non-financial reporting, and internal controls, and reviews reports regarding compliance, fraud and risk management.

We recognize that for our company to be successful over time and to be a force for good, we must also create value for society. Our governance helps us strike the right balance in our pursuit of long-term, sustainable value creation.

Download our Corporate Governance Report 2023 in English (pdf, 2Mb)

Share capital

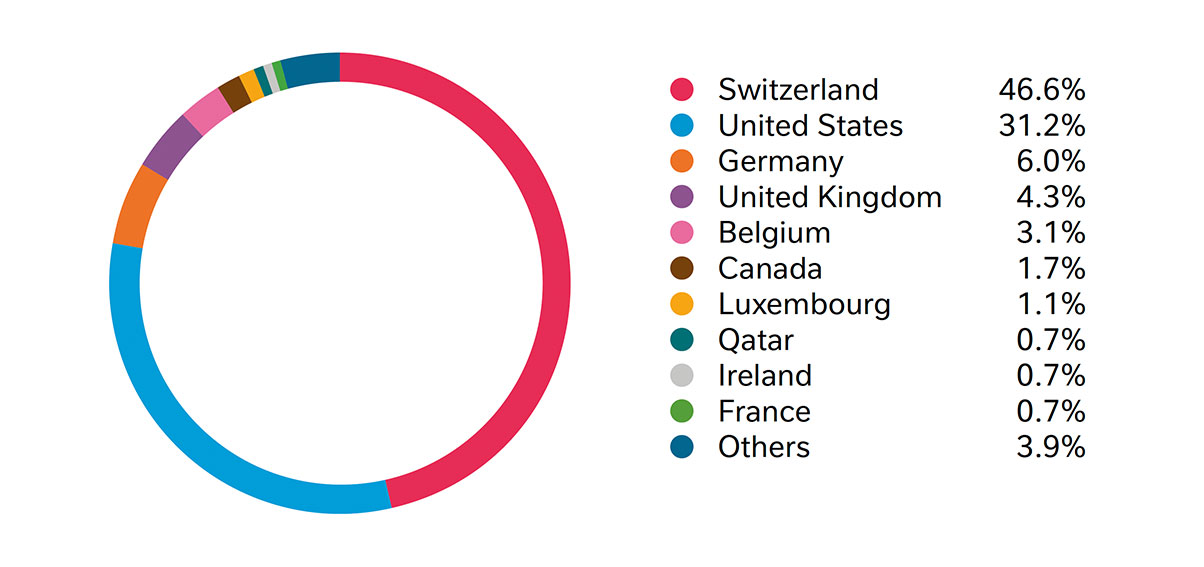

Share capital distribution by geography

| Switzerland | 46.6% |

| United States | 31.2% |

| Germany | 6.0% |

| United Kingdom | 4.3% |

| Belgium | 3.1% |

| Canada | 1.7% |

| Luxembourg | 1.1% |

| Qatar | 0.7% |

| Ireland | 0.7% |

| France | 0.7% |

| Others | 3.9% |

Share capital by investor type, long-term evolution (a)

| Institutions | 75% |

| Private Shareholders | 25% |

(a) Percentage derived from total number of registered shares. Registered shares represent 45.2% of the total share capital. Statistics are rounded, as at 12/31/2023.

Compensation

Our Compensation Committee sets our remuneration principles and prepares the proposals for remuneration. In 2015, we implemented the new Swiss 'say on pay' law both in letter and in spirit. Our proposals were adopted with large majorities of our shareholders. Our Compensation Report explains our compensation system and pay-outs. It is submitted annually to an advisory vote of our shareholders.

Compensation Committee Charter - June 2023 (pdf, 80Kb)

Compensation Report 2019 (pdf, 300 Kb)

Compensation Report 2020 (pdf, 500 Kb)

Compensation Report 2021 (pdf, 500 Kb)

Compensation Report 2022 (pdf, 648 Kb)

Compensation Report 2023 (pdf, 648 Kb)

Changes to compensation

For 2021, we had introduced Environmental, Social, Governance (ESG) related KPIs for the Short-Term Incentive Plan for 15% of its grant value. For 2023, we have added an ESG-related KPI as a fourth performance metric in the Long-Term Incentive Plan for 20% of its grant value and increased the disclosure on the target achievements under our short- and long-term incentive plans.